Is It Time to Panic? Investing During Market Turmoil

How should investors think and behave during uncertain times?

On Monday, Feb 3rd, markets dropped at the open. The consensus view for this was because of the tariff policy on Mexico, Canada and China and what that might mean for US consumers amid increased inflation expectations. Within an hour of the market opening, the Mexican tariffs were delayed by a month and markets partially recovered. Canada soon followed.

And today, Feb 6th, the market has almost fully recovered from the blip of Feb 3rd.

Friends, family and many clients (living in the DC area) are worried about the turmoil that Trump’s policies and Elon and DOGE’s efforts will cause. Cutting jobs and billions of dollars of funding affects so many people where I live.

How should investors respond? Is it time to panic and move money out of the markets?

Let’s take a look.

First, there is always a reason to sell. This chart from Michael Batnick from Ritholtz Wealth Management and The Irrelavant Investor shows reasons to sell from the year 2009 onward:

And believe me, you can make this chart go back a lot further.

Any of the events on this chart could have made you feel like selling everything to cash and holding on for dear life. It was never the right move. In order to time a market crash, you have to sell before things fall apart. Very often, things don’t actually fall apart. If they do, like during the Dot-com bubble, the Great Financial Crisis of 08-09 and Covid 2020, you also have to get back in before things recover.

Many investors who sell get stuck. They always fear another drop and it leads to them sitting in cash for years. Meanwhile, the market has recovered and gone on to all-time highs by the time they get back in.

To quote legendary fund manager Peter Lynch, “Far more money has been lost by investors in preparing for corrections, or anticipating corrections, than has been lost in the corrections themselves.”

So is this new Presidential administration and their actions any different? IS IT DIFFERENT THIS TIME?

To quote Sir John Templeton, “The four most dangerous words in investing are: this time it’s different.”1

A friend of mine shared a newsletter from The Issue on his social media titled, “An Emergency Update About What To Do Right Now”.

I read it since I knew I was about to post something in a similar vein. The writer, Umair Haque, a British economist, has some good advice (paraphrasing):

“Don’t panic. Wait for the dust to settle. Take a deep breath.”

Absolutely!

But then it turns. He talks about tariffs and the Smoot-Hawley Act and the Great Depression. And how your #1 goal should be on minimizing your losses. To me, that clearly means SELL EVERYTHING NOW. I’M TOTALLY NOT PANICKING BUT SELL SELL SELL. GET OUT WHILE YOU CAN.

Wait… that’s not good!

Then I checked out Umair’s previous post and it is titled, “Prepare for Implosion, or This is America’s Brexit Moment”.

Wait…I don’t like the sound of that? So this is the next coming of the Great Depression? It’s an emergency!

What happened to not panicking? I understand why people write this way. Wall Street and the media both thrive on fear. It drives clicks.

How about this cheerful paragraph:

“It’s a sequence that usually goes like this. Prices rise, interest rates have to, businesses close, there’s a wave of bankruptcies, unemployment spikes, demand craters…and so a vicious cycle kicks off. Whatever we call it today, that was how the Great Depression happened. Along the way, financial markets crash, banks fail, and the system implodes.”

Isn’t Umair describing the hallmarks of the normal economic cycle?

Not every cycle includes a depression, but the key to remember here is the playing field today is totally alien to the playing field from 1929. Back then, fraud and front-running were rampant. There was little to no financial regulation.2

Today, we have lots of financial regulation (mostly created because of the Great Depression!) and many more economic tools at our disposal to handle potential market crashes.

I mean, we literally saw a 30% decrease in the stock market in A MONTH during 2020. That was 5 years ago. If we were playing on the 1929 playing field, it’s very possible the Covid crisis could have led to an 80% drawdown. But it didn’t! Markets recovered and then zoomed to all-time highs a month later, largely due to fiscal and monetary policy tools at our disposal in this current era.

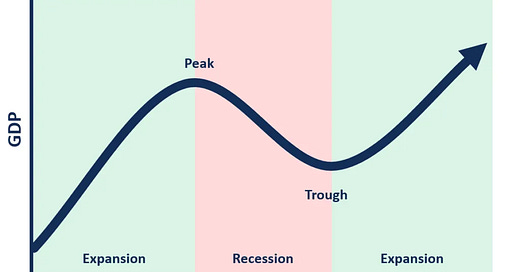

A big reason people panic is they don’t have a plan and they don’t fully understand market cycles.

If you understand that market crashes happen (and frankly, are inevitable), you would have confidence knowing your financial plan accounts for rough periods. This includes younger folks still working and older folks no longer working. If you are retired and don’t account for prolonged periods of poor market returns, you don’t have a proper plan.3

Umair does say, “Don’t, do not, buy or sell. Stocks, bonds, anything. Don’t do it. Let me repeat that, don’t buy a stock or sell a stock or financial contract of any kind.”

This post is for educational purposes only and I do not provide financial advice through this newsletter, but if your financial plan dictates that you continuously buy financial instruments each month, you should always be evaluating what factors would change this. Losing your government job certainly could be a good reason to put asset purchases on hold. I would be wary of recommending changing your financial strategy based on a few government policies.4

We don’t know what the future holds, but giving into fear is not and has never been a successful investing strategy.

If you want your personal finance questions answered in a future Mound Visits, comment below or send me an email at nick@nineinningfinance.com with your question/scenario.

Also please share this post with anyone you think might find it helpful.

Nothing in this email is intended to serve as financial advice. I don’t know your personal circumstances and would never provide financial advice through this medium. This newsletter is intended to be educational and entertaining. Please consult a financial professional and do your own research before making any changes to your portfolio.

Ok that’s enough quotes from legends in one post.

There is certainly fraud happening today. But it used to be totally unchecked fraud, now we have a system of checks and balances. There is a reason why people like Bernie Madoff and Sam Bankman-Fried get caught and put in jail now!

For my next post, I plan on writing about how to account for prolonged periods of poor market performance in your strategy.

The tariffs already backtracked. At the end of the day, incentives drive everything. Do the billionaires in power want to tank their own fortunes?